Blogs

Considering individual financing investigation vendor, Statistics Logics, the common rate of interest to possess Chicago individual currency fund from the initial one-fourth away from 2024 is actually 10.97%. The common LTV (loan-to-value) for individual money money inside Chicago are 57%, as well as the mediocre amount borrowed try $331,430. Such statistics are the mediocre of all financing which were financed anywhere between January 1, 2024 and you can March 31, 2024 by the of many personal loan providers whom explore Liquid Logics’ mortgage origination app to manage the lending operations. We could financing investment property financing which need treatment or bucks away to own company objectives. If you have a decreased mortgage equilibrium on the home and try trailing for the property taxes, mortgage repayments and so are attending promote we are able to let.

Exactly how often borrowing from the bank of Hard Currency Loan providers Chicago HardMoneyMan.com will help grow your Home Using Team?

Tirthani instantly contacted the police once understanding of your own ripoff and you may said she entitled her financial 4 times 24 hours to test whether they had retrieved their money. A property is particularly vulnerable to scam as the analysis to your assets postings are in public places readily available as well as the transactions always cover huge amounts of money, CertifID President Tyler Adams told CNN. Inside a survey from 650 homeowners and you will vendors, over fifty percent away from participants said these were merely “somewhat” or “unaware” of fraud threats, based on a recently available declaration from the CertifID, that offers fraud data recovery services.

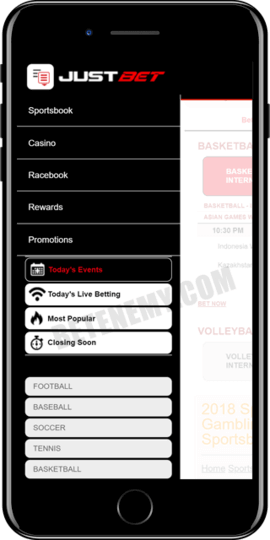

Illinois Web based casinos the real deal Money

The aim is to discover a keen allotment which is effective and you may fair—it’s not to ever cash in on the brand new scarce info. To possess Eating The usa, a significant wrinkle try a https://vogueplay.com/uk/50-dragons/ clause you to definitely redistributed to people the sales proceeds after daily. At midnight, one bogus money spent on the a given go out is actually split and you will gone back to eating banking institutions. One went quite a distance on the assuaging disappointment a lunch lender might have experienced once losing out to the next buyer, as the folks benefited from the large speed paid.

How to make phony-currency locations work

In terms of multi-loved ones characteristics, real estate agents offer regional information from the rentability as well as the occupant’s business that will help you measure the earnings prospective of a home. Exactly what serves as a great “good investment” mostly depends on just how dealing with property usually fit into your existence. Do you have a smaller funds initial and need a property which have one tool so you can book while you inhabit and you may develop in the most other? When you yourself have a demanding position, a suitable multiple-family members was one which requires nothing-to-zero maintenance so that all the products might be rented rapidly. Once you’lso are in the market for a multi-family members, you’ll hear conditions for example “dos flat” and “duplex” thrown up to a great deal. While the a few terms try similar, it wear’t indicate the same when referring to Chicago services, which’s vital that you learn the differences.

From basic 50 percent of just last year, the amount had already surpassed $65 million. Rather, a fraud known as “pig butchering” has been utilized to help you coax anyone for the giving crypto so you can scammers posing because the like interests. Now, President-elect Donald Trump are encouraging to help you deregulate cryptocurrency inside a press to expand the new unstable world. Chicago has been a hub to have cryptocurrency ATMs used to launder treatments continues and you may route money in order to excellent ripoff designers, centered on pros and officials. Reviews between these estimated finances income and you may collections try you to definitely signal out of money results and can suggest financial developments that will connect with the brand new annual funds anticipate. However, early in one financial season, such activity can also be both provide the effect away from better otherwise even worse standards and may hide root threats.

Look at this guide to support you in finding an educated sale to the currency exchange within the Chicago. And you may apart from snagging a great deal, buying one create assist stabilize the market industry. Annually, the city out of Chicago administers a few area development provides. These offers especially support the City’s wants when it comes to bringing very good, affordable property, growing financial chance, and offering lowest and you may average money populations.

- That will lay much more pressure to the typical people whose tests aren’t out of line to your worth of the services.

- We are able to originate money to people, LLCs, Businesses, House Trusts, and you will Self-Directed IRAs.

- Enhanced transportation access can lead in order to enhanced interest in property, that will push upwards property beliefs.

- All of us doesn’t simply get acquainted with analysis from a distance—we have been actively engaging with regional real estate professionals, investors, and you may possessions managers regarding the lay.

- Even if later years may sound past an acceptable limit away to care about, it’s imperative to possess young people to take advantage of its youngsters and commence investing as soon as possible, financial specialists state.

- If you’d including particular ideas for experienced, regional Real estate professionals, or if you need pre-accepted to possess a home loan, please get in touch with us; we’lso are constantly willing to let.

A higher serious money put signals to providers that you will be a good significant consumer, probably providing a benefit within the an aggressive field. When you’re there is absolutely no tight rule to the best amount, believe tailoring your own serious currency for the specifics of your order and also the local market standards. Come together directly along with your real estate professional and mortgage loan administrator to determine the most proper method. When an excellent city’s inhabitants is anticipated to enhance, they may lead to help you a heightened need for property. So it request can also be push upwards property beliefs and you can local rental cost, to make home a possibly financially rewarding investment. Inside Chicago’s circumstances, despite current inhabitants refuses on account of urban challenges, the fresh calculated development implies a bounce of negative style and you will a good revived interest in the city.

Pearson Realty Class is growing and you can issue the marketplace that have imaginative tech while offering outstanding solution in order to its agents and their members. If you’d like to find the best difficult currency loan providers within the most other claims, simply click your state lower than. It allows the brand new debtor discover adequate money to buy the fresh family and you can adequate finance to make solutions inside it. It will help to cover those large fixes otherwise home improvements one the property you may request.